US Jobs Report Seen Underscoring Economy’s Resilience

U.S. employment returned to its pre-recession peak in May with a solid pace of hiring that offered confirmation the economy has snapped back from a winter slump.

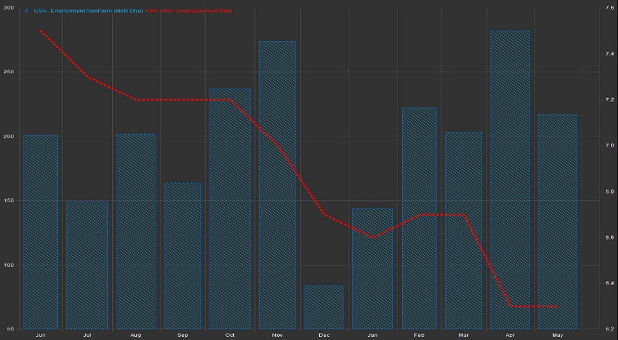

Nonfarm payrolls increased 217,000 last month, the Labor Department said on Friday, in line with market expectations. Data for March and April was revised to show 6,000 fewer jobs created than previously reported.

“This was a very solid report with no obvious warts to detract from the underlying message of sustained improvement in economic activity,” said Millan Mulraine, deputy chief economist at TD Securities in New York.

May marked a fourth straight month of job gains above 200,000, a stretch last witnessed in January 2000, even though it also was a slowdown from the 282,000 jobs created in April, when hiring was still bouncing back from a winter lull.

The nation finally recouped the 8.7 million jobs lost during the recession, with 8.8 million more people working now than at the trough in February 2010. But the working age population has since increased 10.6 million while 12.8 million Americans have dropped out of the labor force.

The upbeat jobs report hoisted U.S. stocks to record highs. U.S. Treasury debt prices slipped, while the dollar was little changed against a basket of currencies.

ECONOMY GAINING TRACTION

The pace of hiring adds to data from automobile sales to services and factory sector activity that have suggested the economy will grow at a pace of more than 3.0 percent this quarter after shrinking at a 1.0 percent rate in the first three months of the year.

Other data on Friday showed consumer credit in April recorded its largest advance since November 2001, a sign households were feeling more secure in taking on debt.

Last month, the unemployment rate held steady at a 5-1/2 year low of 6.3 percent as some Americans who had given up the search for work resumed the hunt.

A measure of underemployment fell to its lowest level since October 2008. The gauge, which includes people who want a job but have given up searching and those working part-time because they cannot find full-time jobs, fell to 12.2 percent.

Economists expect more previously discouraged workers to re-enter the labor force over the course of the year. While that would be a sign of confidence in the labor market, it could slow the decline in the jobless rate.

The long-term unemployed accounted for 34.6 percent of the 9.8 million jobless Americans, down from 35.3 percent in April. The median duration of unemployment fell to 14.6 weeks, the shortest stretch in five years and a sharp drop from April.

“We are making progress, but we still have a very long way to go,” said Ryan Sweet, a senior economist at Moody’s Analytics in West Chester, Pennsylvania.

The return of discouraged job seekers and drop in long-term unemployment will be welcomed by the Federal Reserve, which has cited low labor force participation as one of the reasons for maintaining an extraordinarily easy monetary policy.

The workforce, which had declined sharply in April, increased by 192,000 people last month. That left the labor force participation rate, or the share of working-age Americans who are employed or at least looking for a job, at 62.8 percent.

Average hourly earnings, which are being closely watched for signs of wage pressures that could signal dwindling slack in the labor market, rose five cents, or 0.2 percent. On a year-over-year basis, earnings were up a tepid 2.1 percent, suggesting little build-up in wage inflation.

But earnings in some sectors, such as mining and information services, are rising at a much faster clip.

“It’s a difficult time for Fed policymakers,” said Peter Molloy, president at Edison Investment Research in New York. He said the central bank normally would be raising interest rates by now given the level of the jobless rate but wanted to go slowly because the recovery has been weak by historic norms.

The Fed has kept benchmark overnight rates pegged near zero since late 2008 and is not expected to begin nudging them up until well into next year.

Employment gains in May were broad-based.

Manufacturing payrolls increased by 10,000, expanding for the 10th straight month. Further increases are expected as auto sales outpace inventories.

Construction payrolls rose by 6,000. It was the fifth consecutive month of gains, but the pace is slowing as the housing sector struggles to regain momentum.

There were sturdy job gains in leisure and hospitality, and professional and businesses services. Healthcare added 33,600 workers, likely boosted by the implementation of the Affordable Care Act. Government payrolls increased 1,000, a fourth straight monthly increase. Retail employment also rose.

The length of the workweek held steady at 34.5 hours, with a measure of total work effort rising by 0.2 percent.

Reporting by Lucia Mutikani; Additional reporting by Jason Lange in Washington; Editing by Andrea Ricci, Tim Ahmann and Chizu Nomiyama

© 2014 Thomson Reuters. All rights reserved.