Expect This Problem for Ted Cruz to Come Up in Thursday’s Debate

It’s never been a secret that Ted Cruz’ wife, Heidi, is a managing director for Goldman Sachs.

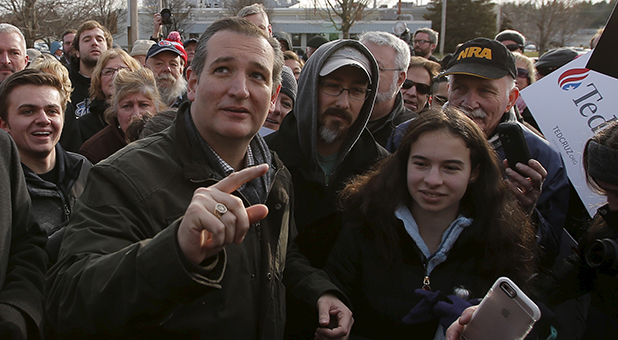

It was an irony the Texas senator has often had fun with while on the 2016 presidential campaign trail. But a new report published Thursday morning in the New York Times suggests there may have been more to that relationship than has been previously disclosed—at least to the Federal Election Commission.

According to the Times, Cruz said his wife gave her blessing to liquidate their family’s assets to fund his 2012 run for U.S. Senate. The $1.2 million listed in FEC filings were all they had saved, according to a 2013 interview referenced in Thursday’s report, but that’s not entirely true:

“A review of personal financial disclosures that Mr. Cruz filed later with the Senate does not find a liquidation of assets that would have accounted for all the money he spent on his campaign. What it does show, however, is that in the first half of 2012, Ted and Heidi Cruz obtained the low-interest loan from Goldman Sachs, as well as another one from Citibank. The loans totaled as much as $750,000 and eventually increased to a maximum of $1 million before being paid down later that year. There is no explanation of their purpose.”

The Times reported the loan was not disclosed to the FEC, but did confirm with Cruz spokeswoman Catherine Frazier the loan’s existence. A line of credit through Citibank also was not disclosed, according to the report.

The Federal Election Campaign Act requires not only the loans be disclosed, but also the terms under which they were secured. The law requires the FEC determine that any loans are not overly favorable to a candidate, and that they were conducted in the course of normal business.

These disclosures are generally made on several forms, which are released publicly on a quarterly basis.

The lack of disclosure is not a major violation, and based on past precedent, usually doesn’t result in any fines. Cruz responded directly to the issue Wednesday night, following a campaign stop in New Hampshire, saying it wasn’t a personal loan, but rather a margin loan against his wife’s brokerage account.

A “margin loan” is a type of financing backed by an investment portfolio, typically for the purpose of financing additional investments. The ability to borrow funds is determined by the assets in the portfolio, their loanable value, and a credit limit based on the borrower’s financial position.

It is very likely the issue will come up during Thursday night’s Republican presidential debate on FOX Business Network. It begins at 9 p.m. EST.