The basics of the long-awaited tax reform plan are finally out, and financial expert and nationally syndicated host Dan Celia has one hope—that Republicans don’t squander the chance to change the financial outlook for millions of middle-class Americans and small business owners.

“This tax proposal will cut the small business tax rate to the lowest level in 80 years,” Celia said. “Lawmakers must listen to the American people and understand how truly significant this is. If the American people realize the truth of what these cuts will mean for their businesses and their families, Democrats coming up for reelection will have little choice but to support the bill. Small business owners will be able to keep more of what they earn, which means those who want to grow will be able to do just that—grow.”

Celia, who wrote op-ed on the topic recently for Townhall.com, where he is a featured columnist, added that close to 75 percent of small business owners have adjusted gross incomes of less than $100,000 per year and make up 99 percent of employers in America. Small businesses also employ just over 50 percent of all working people.

“Small business owners are the heartbeat of America and need to once again become a growing segment of our middle class,” Celia said. “Reducing the 35 percent federal income tax for corporate America to 20 percent will also help America compete with other countries. Allowing corporate America to bring foreign earnings back to the U.S. that could be as high as $4 trillion will create jobs, increase American wages, dramatically increase the tax base for many states and create an environment of prosperity.”

The current tax cut plan will allow individuals to see more money in their pockets and watch their finances stabilize, while at the same time instilling confidence and positive consumer sentiment.

“Dollar-for-dollar credits on taxes owed will financially help families in real and tangible ways,” Celia said, “and this is discretionary income for families who have the responsibility of providing for their children. The tax plan is a win for America. We must continue to remind lawmakers that we the people will be working hard to continue to drain the swamp and bring America back to economic greatness.”

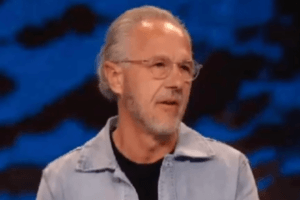

Celia leads Financial Issues Stewardship Ministries (FISM, financialissues.org) and focuses on important economic news and biblical investing during his daily, three-hour program, “Financial Issues,” heard on more than 630 stations nationwide and seen on NRBTV, which reaches 45 million households.

See an error in this article?

To contact us or to submit an article